Table of Contents

- Making Tax Payments with IRS Direct Pay - YouTube

- How to apply for a payment plan online with the IRS - YouTube

- How to make a tax payment online to the IRS - YouTube

- IRS Direct Pay is a secure service to pay your taxes. #irs #direct #pay ...

- How to report direct tax payment to the IRS or State?

- The Best IRS Payment Plan Options Available in 2022 - Atlanta Tax Attorney

- How to View Your IRS Tax Payments Online • Countless

- How to pay your taxes with IRS Direct Pay [Step-by-step guide]

- Tax Estimator - Tax Hive - Strategic Tax Planning

- IRS Direct Pay Site Down on Tax Day - YouTube

What is IRS Direct Pay?

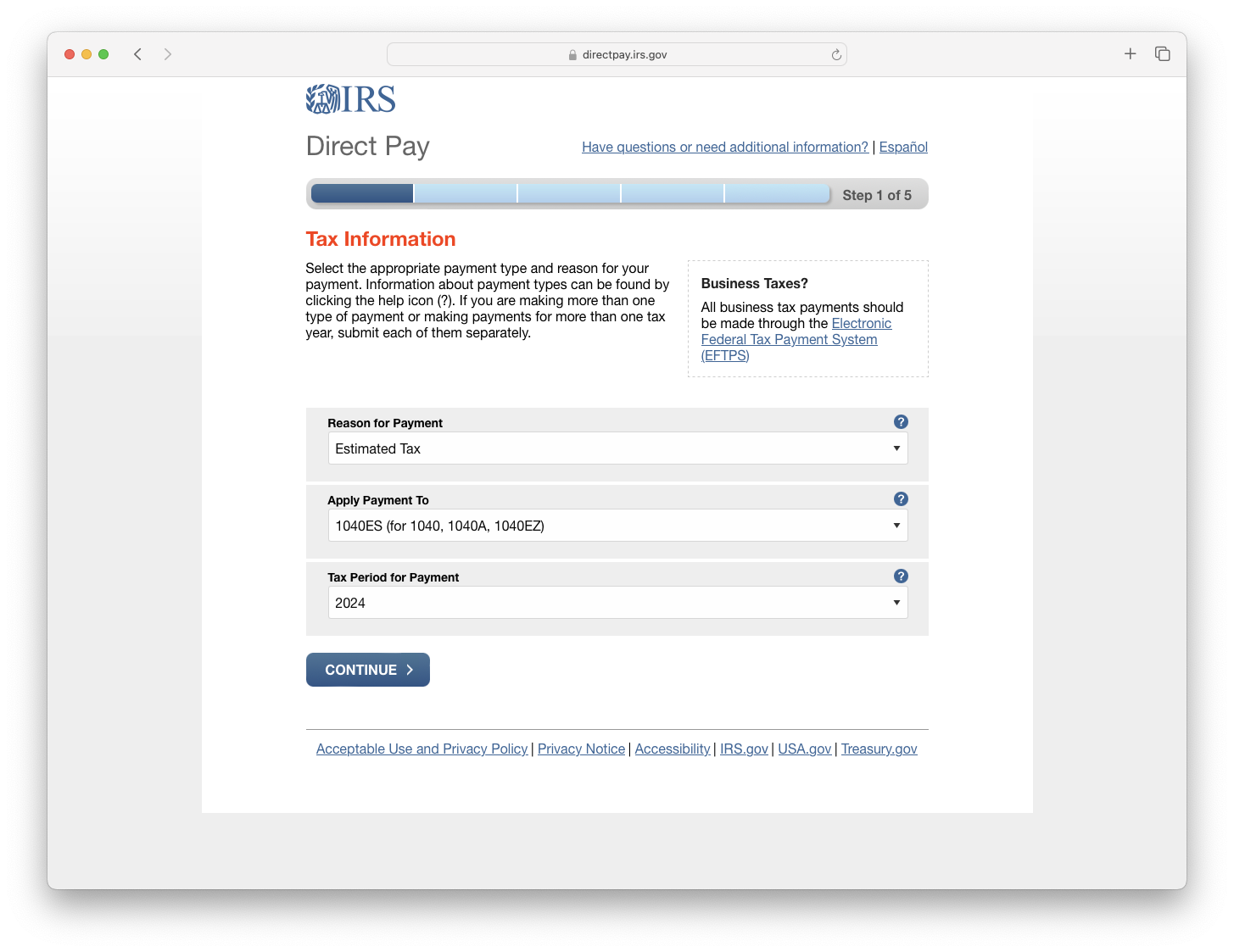

![How to pay your taxes with IRS Direct Pay [Step-by-step guide]](https://www.dimercurioadvisors.com/hs-fs/hubfs/blog-images/137-direct-pay/irs-direct-pay-step-1.png?width=9204&name=irs-direct-pay-step-1.png)

Benefits of Using IRS Direct Pay

How to Use IRS Direct Pay

Using IRS Direct Pay is a straightforward process. Here's a step-by-step guide to get you started: 1. Visit the IRS website at irs.gov and navigate to the Payment Options page. 2. Select the type of tax payment you want to make (e.g., individual, business, etc.). 3. Enter your payment information, including the payment amount and payment date. 4. Verify your identity and confirm your payment details. 5. Submit your payment and receive a confirmation number.