Table of Contents

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

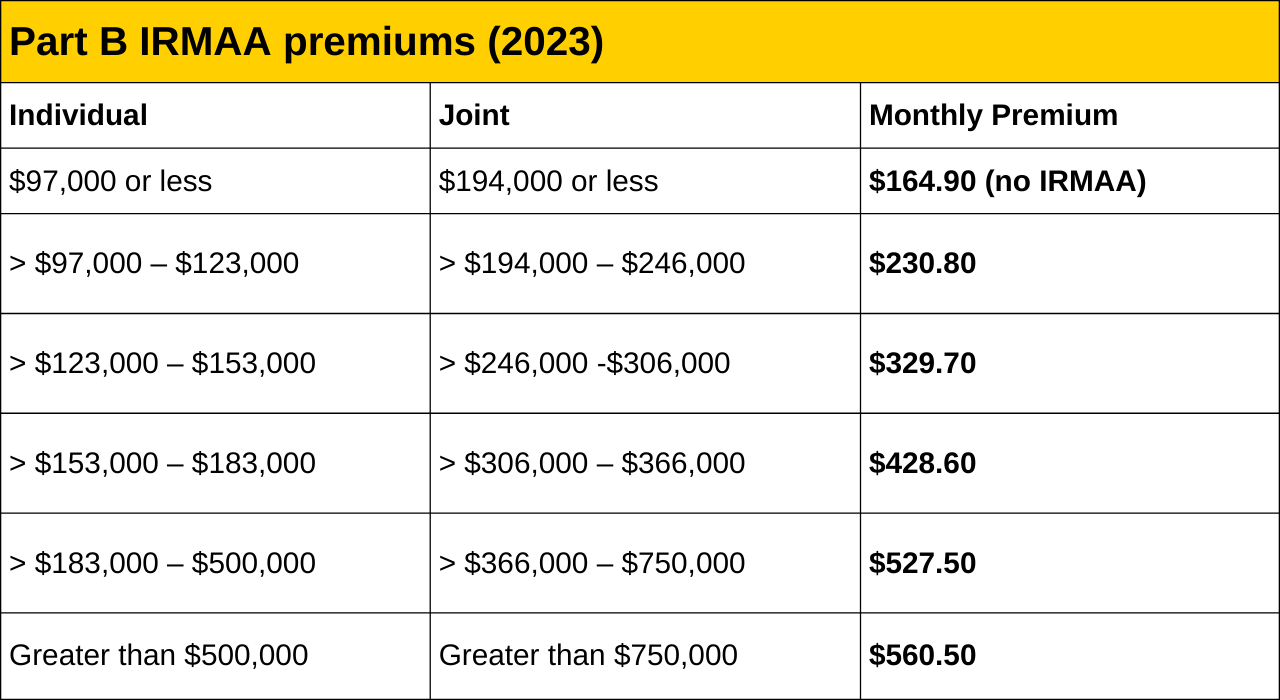

- 2023 Medicare Part B & IRMAA | AFSCME District Council 37

- Making Sense of Medicare IRMAA, a Universally Confusing Topic ...

- 2025 Medicare Premiums and Deductibles | Senior Advisors

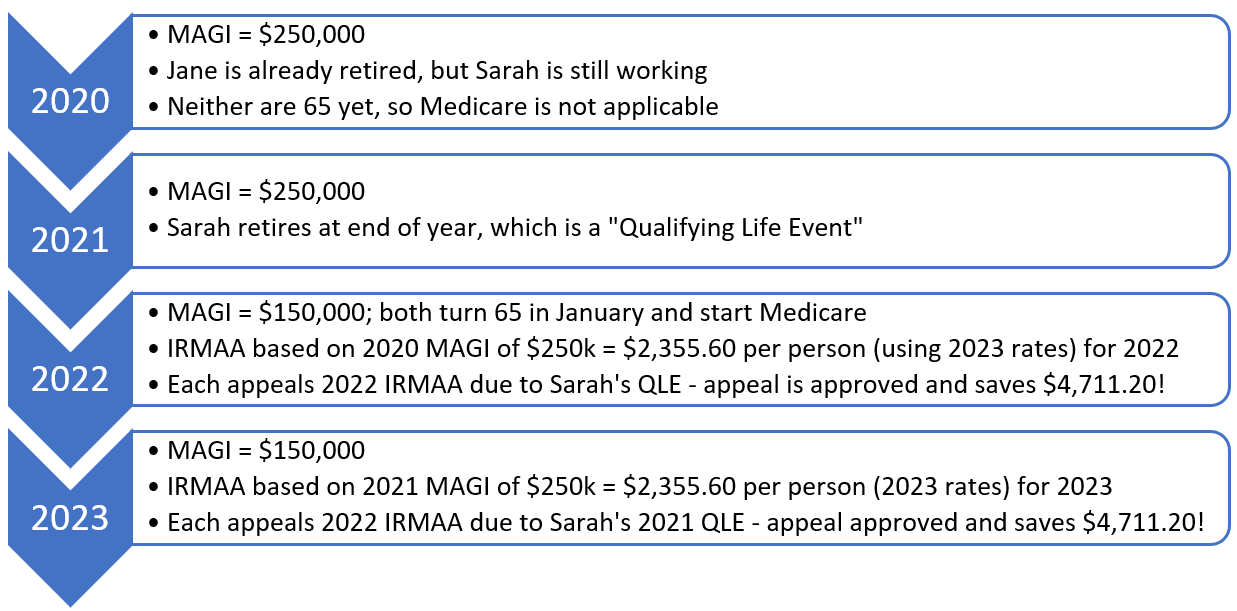

- How High-Net-Worth Retirees Can Prepare For Medicare IRMAA

- How High-Net-Worth Retirees Can Prepare For Medicare IRMAA

- Medicare Premiums and Coinsurance in 2025 - Meld Financial

- 2024 Medicare IRMAA Explained - YouTube

- Understanding IRMAA: How Income Affects Your Medicare Premiums - Policy ...

- 2024 Medicare IRMAA Explained - YouTube

What is IRMAA?

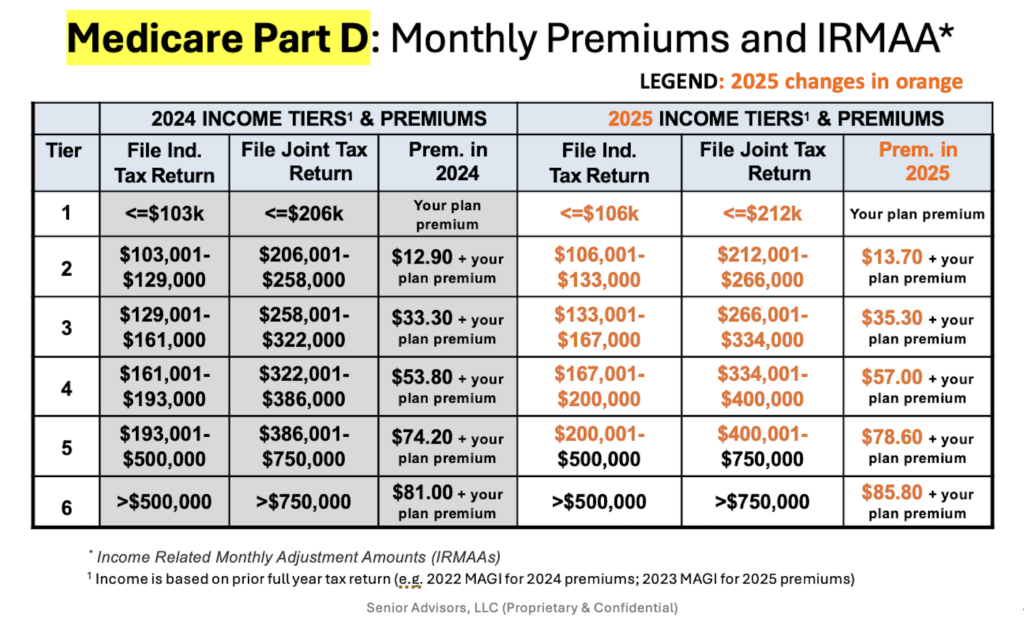

IRMAA 2025 Thresholds and Premiums

How IRMAA Affects Humana Medicare Plans

If you're enrolled in a Humana Medicare Part D or Part B plan, your IRMAA will be added to your monthly premium. For example, if you're a single filer with an income above $183,001, your IRMAA for Part B would be $71.30, and for Part D, it would be $25.10. You'll need to pay this additional amount each month, on top of your standard Humana Medicare premium.